AZ Public School Tax Credit

If you hold Arizona income tax liability, you can make an Arizona Tax Credit contribution to DMS. Through the AZ Public School Tax Credit, you may donate up to $200 (individual) or $400 (married, filing jointly) and receive a dollar-for-dollar reduction in the taxes you owe the state.

(*Please note: a tax credit donation is not the same as donating to the annual Sustaining Fund. If you would like to make a critical, unrestricted donation to support DMS, please click here.)

We ask every family to donate their Tax Credit to DMS and invite their extended network to do the same. If you have already given, encourage friends and relatives to participate! Please read through the DMS Tax Credit FAQs below to see how your tax credit contribution benefits Desert Marigold School. For questions regarding your tax liability, please consult with your tax professional.

Valley of the Sun Waldorf Education Association – Desert Marigold School

District Number 07-89-64-101 | Tax ID #: 86-0769535

Make your Tax Credit donation today.

-

As a community member, you’ve likely heard of the various trips that classes take over the years. In addition to smaller field trips beginning in Grade 3, your student will experience a range of class trips throughout their DMS journey, including the Grade 5 Pentathlon, Grade 6 Medieval Games, and the Grade 8 class trip. The high school participates in multiple class trips throughout the years as well.

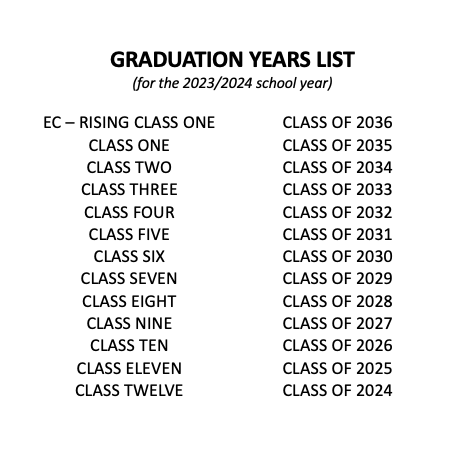

Our Tax Credit initiative is to build class funds large enough to support each class as they embark on these trips. The goal is to increase each class’s fund over the years, with the hope to either cover expenses entirely or, at the very least, significantly reduce each family’s out-of-pocket cost. Class funds will be created for individual grades 1-8 and begin again in high school grades 9-12.

For example, if your child is in Grade 1, their class will receive an individual Tax Credit fund that belongs to the class. Any Tax Credit donations given to their class will accrue within this fund and follow them year after year until Grade 8. Parents/guardians and community members may donate to their fund each year. The class may then use these funds to help finance class trips or various classroom needs eligible under Arizona Tax Credit law. If each family participates to their full ability each year, a substantial amount of money could be raised with almost no effort.

PLEASE NOTE THAT THE CHILD WILL NOT RECEIVE A CREDIT FOR THEIR SPECIFIC TRIPS BUT THE DONATION WILL BE APPLIED TOWARD THE CLASS AS A WHOLE TO REDUCE THE COST FOR EVERYONE.

-

The tax credit amount will be applied to the class fund as a whole and not an individual child. This will lower the cost for the entire class to help ensure that everyone can afford to go.

-

You can receive a dollar-for-dollar tax credit by donating any amount up to $200 per individual or $400 per joint filing.

For example, if you donate $200, you will receive a $200 tax credit from the state – either as a credit or refund – when you file your taxes in the spring.

You may submit your donation in a single payment or over multiple payments, up to the maximum amount for which you qualify. To claim your tax credit, you need to donate by Tax Day.

-

You must be an AZ state taxpayer to participate.

-

Yes, you may divide your tax credit donation evenly between multiple classes, up to the maximum amount for which you qualify (up to $200 per individual or $400 per couple).

-

No. Any individual or couple paying AZ state income taxes may donate.

-

You can donate as late as April 15, 2024, and claim it against the previous year’s taxes. If you’re unsure how the tax credit impacts you, please consult your tax professional.

-

You will receive a tax receipt after completing your donation. Submit this receipt with Tax Credit Form 322. You can find more general tax credit information on the website of the AZ Dept. of Revenue’s tax credit page. If further guidance is needed, please consult your tax professional.